“The real estate industry will continue its growth trajectory and now is the best time to invest,” Lobien Realty Group (LRG) CEO Sheila Lobien announced, in the company’s recent market update briefing.

LRG, the fast-rising real estate service provider said that it “maintains its positive outlook as investments in the industry have shown resiliency and growth in terms of actual construction and credit or loans taken.”

The growth has been five-fold in the past 10 years. Lobien emphasized that the company’s outlook is positive “regardless of what was happening in the country’s economy.”

Lobien noted that office and residential markets have continued adding supply; and rent and capital values have always increased.

For the past 18 years, LRG reported a 300% increase of rent for office space and capital values for condominium units in Metro Manila.

“Demand for office space in Metro Manila is very robust, registering a 1.1 million square meter take up in 2018, which is expected to be at the same level in 2019,” Lobien said in the statement.

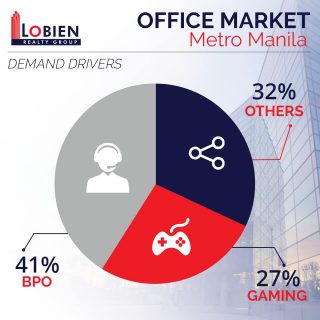

LRG continues to observe that the Business Process Outsourcing (BPOs) and On-line gaming companies (POGOs) are main drivers in the demand for office space, taking up 41% and 27%, respectively.

High supply

“The industry is ready to meet the robust demand in office space,” Lobien said.

Anticipated to be built over the next five years will be another 2.4 million square meters of additional office space, setting a record high supply growth across Metro Manila cities.

Anticipated to be built over the next five years will be another 2.4 million square meters of additional office space, setting a record high supply growth across Metro Manila cities.

The supply growth is led by Makati (505,000 sqm), Quezon City (450,000 sqm) and Taguig/BGC (400,000 sqm).

“As what is being supplied is taken up, rental values have also reflected significant upswing despite the growth in space supply, especially in Bay Area/Entertainment City (27%), Taguig/BGC A&B (14%) and Makati A&B (13%),” LRG said.

“Over-all, the real estate industry is in a very stable spot,” the CEO emphasized.

Focus on infrastructure

To sustain the Philippine’s economic growth, Lobien said that the “Build, Build, Build Infrastructure project of this administration should be realized to maintain or even improve the country’s competitiveness in terms of infrastructure, which currently lags behind its Southeast Asian neighbors.”

LRG reiterated data on the Philippine economy registering sustained economic growth such as those in 2001 and 2013.

“Hence, barring any major local and global crisis, the next three years for the Philippines will show a continued trend of positive economic performance,” the statement said.

LRG also added the new positive developments that boost the country’s infrastructure and planned private and public spending. This includes the recent S&P credit rating upgrade to BBB+ given last April 2019 and the BSP’s cutting of the banks’ reserve requirement by a cumulative of 2% spread over the next three months.

“These will help further the positive economic trajectory of the country,” Lobien said.