Caesar Vallejos

OPEN FOR BUSINESS, Eagle News Service

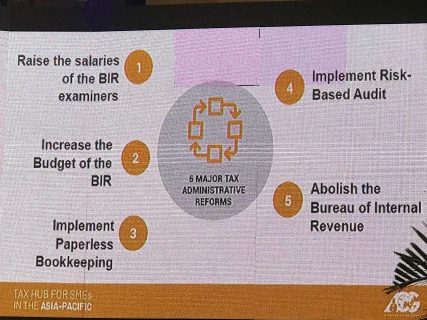

The newly appointed Co-Chair of Ease of Doing Business in Paying Taxes, Mon Abrea, the Founding President of the Center for Strategic Reforms of the Philippines, said that “administrative reform should supplement or support any policy reform.”

In his talk at the Asia CEO Forum last February 22, 2019 at the Marriott Hotel, Abrea said, “dito kami madalas nag-co-conflict with DOF, we really have ideas on policy reform but apparently the administrative reform is not funded. It is sad that we keep talking about reform but you don’t want to give budget to BIR.”

“If a strategy is not funded, it is useless.” Abrea said. He noted that a BIR examiner receives a measly salary of P21,000 yet “he is tasked to collect P3.3 trillion for the budget of government this year.”

“There are policy reforms but we need to fund it. We cannot rely on international funders or probably PPP.” Abrea said he had recently met with BIR Commissioner Caesar Dulay to talk about various strategies including automating compliance “but the Commissioner was very honest – that we don’t have budget.”

“If we want to achieve a genuine tax reform, it is not just legislative, we cannot just keep lowering or adding taxes, it has to be strategic that it will unburden our people at the same time encourage compliance,” Abrea noted.

He said that the real reform is also in the improvement of collection and not on the imposition of new taxes.

Known for his straightforward public criticisms directed to the BIR, Abrea explained “I am not criticizing BIR as an agency, I am criticizing the mandate that you ought to do as the tax collection agency – to help and assist – and not to harass us [taxpayers].”

He added: “do not treat us like criminals and the BIR audit needs to be overhauled and I am very happy that we are working with the BIR Commissioner.” Abrea described the commissioner as someone “who listens” and acts immediately to complaints.

Abolish BIR?, Only in the Philippines

“We are proposing to abolish BIR,” Abrea suggests. “But ‘abolish’ means not to get rid of them but to set up a new internal national revenue authority like in Singapore where their salaries are much competitive, at least P100,000 not P20,000.”

Furthermore, this new set-up “will use technology and enough manpower not to run after us but to assist every tax payer online or offline. We don’t even need RDOs in every city. It should be in the mall online, everywhere. Government must provide all channels with all options so that anyone at any point in time can file and pay taxes,” he urged.

The Philippine Tax Whiz calls for a paperless book keeping. “Only in the Philippines that you will get charged P50,000 because you did not update your manual books of accounts. Only in the Philippines that they don’t care whether you paid taxes; but if you don’t write anything on your books of accounts, you are a tax evader!”

Pera o Papel?

Abrea said not knowing “a taxpayer who can be awarded for complying 100% with all the requirements of BIR especially in documentations.”

“What do you really want, pera o papel? You cannot burden with the taxpayers giving a lot of documents and at the end of the day still paying a lot of taxes. If they pay their taxes, don’t bother them anymore,” he said.

“Run after those who are not registered, those who are not paying anything at all and those who are suspicious; probably a smuggler or those doing illegal things but those who may be remiss in some of the requirements, assist them, help them, teach them so that the next time around they will be a better tax payer,” Abrea stressed.

Highest tax rates

According to Abrea, “the inefficiency of the tax system is not something that is brought by this administration. It is inherited from many many administrations. It has been there for the last 30 years.”

He said that it is high time that the high taxes should be reduced. The too complicated and too costly compliance should be reduced to a minimum that is acceptable to every Filipino especially to the small taxpayers.”

“How can you honestly ask a sari-sari store to comply with the requirements that even SM malls are having a hard time,” Abrea challenged.

He said that there is only less than 20% of Filipinos who are registered as tax payers.

“Imagine, we are burdening a few of us to shoulder the funding that our government needs to serve 106 million Filipinos,” he cited.

Abrea said that government needs the “broadening and increasing of voluntary tax payments and not discouraging and shying away taxpayers.”

No more reason not to pay

“Tax amnesty without lifting the bank secrecy is a joke.” He said that the amnesty that was passed by the House and Senate is “like a body without soul, without spirit. Sana hindi na pinirmahan, sana inulit na lang. It is a waste of tax money.”

Abrea stressed that it is high time that “we make our examiners accountable for their assessment – reasonable assessment not based on the imagination.” Hence, there is “a need a risk-based audit.”

“You run after those who are not declaring anything, those who are not paying taxes, not for those who are failing or making mistakes,” he said. “Keep the process simplified and ultimately automating it,” he added.

Abrea announced the existence of a free mobile app where “tax payers can file and pay anytime they want, giving all means possible so that every Filipino will have no more reason not to pay, where everything is done using mobile.”

Every Filipino’s concern

Abrea encouraged tax payers to support the reform. “Educate ourselves and comply as honest as we can. Global competitiveness is every Filipino’s concern. If our ranking is going down we need to keep on thinking on how to improve it. But do not pass it on to the government.

“Sometimes that is our tendency: we just rant, complain on Facebook, doon na natapos,” he noted.

So to broaden the tax base, he suggested that “we have to make sure that we only deal with the legit and honest taxpayers. End corruption by not bribing. The only way to stop tax evasion is to stop dealing with dishonest taxpayers even among employers. If your employer is a tax evader, find another employer.”

“This is not just about government making money, this is about helping each other and empowering every Filipino be engaged as a nation builder. This is not how much you pay, this is about giving your share,” the Tax Whiz concluded.