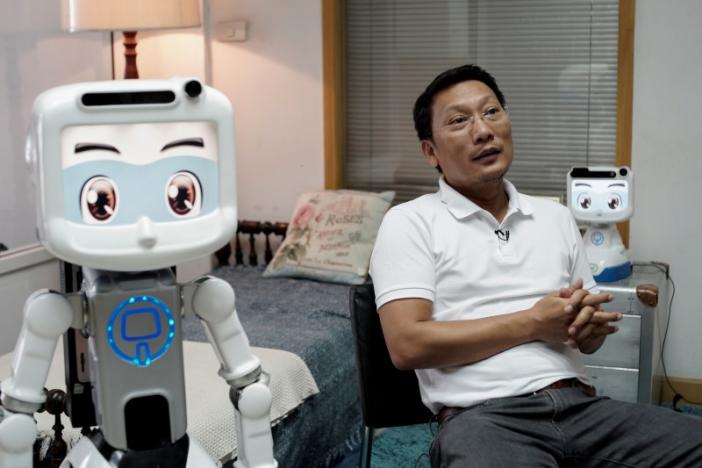

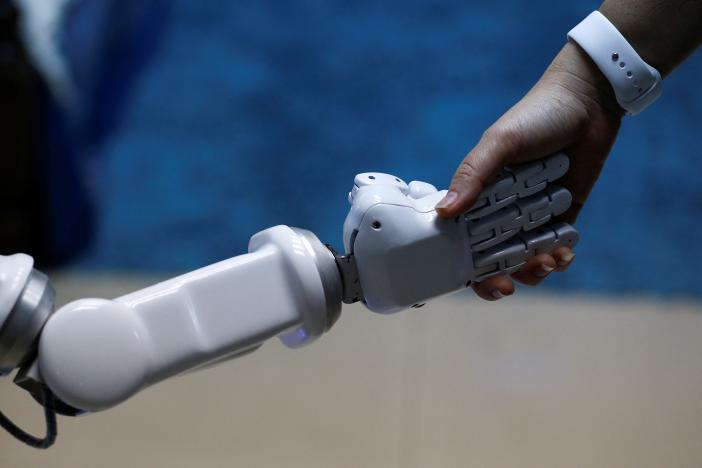

(REUTERS) Thai elderly care robot Dinsow can not only keep track of your medication and video-phone your relatives, but can also exercise with you and even entertain you with its karaoke skills.

Its manufacturer, CT Asia Robotics, is one of many Thai firms investing heavily in healthcare for the aged in a country where the working-age population will decline this year – a first among the emerging economies of Southeast Asia.

By the end of 2016, almost 15 percent of Thailand’s roughly 68 million people will be over the retirement age of 60. The government expects the proportion to reach 20 percent by 2020, adding strain to an already stretched healthcare sector.

“Doctors and nurses have responded positively to Dinsow because it helps them monitor patients,” said Chief Executive Chalermpon Punnotok. CT Asia Robotics has got 1,000 orders from Thailand and Japan for the 85,000 baht ($2,445) droid, he said.

Thailand’s population swing toward the elderly comes as living and education costs rise along with economic development that has outpaced neighbors, according to the World Bank.

The government estimates households spend almost of third of their income on caring for elderly relatives, and KGI Securities estimates healthcare spending will be as high as 7.0 percent of gross domestic product by 2026 from 4.5 percent in 2015.

Thailand’s $4 billion medicine and healthcare industry is therefore gearing up for a surge in demand for elderly care products, as well as for doctors, nurses and care givers, plus hospital beds, nursing homes and customized private housing.

Housing developers such as Sena Development PCL and Nusasiri PCL have been adding features to cater to elderly tenants, such as ramps for wheelchair users, sliding doors, touch-screen light switches and emergency alarm systems.

“Elderly clients make up about 10 percent of our customer base,” said Sena’s Deputy Chief Executive Kesara Tanyalakpark. “That could easily rise to 15 percent or more in coming years.”

In personal products, diaper maker DSG International Thailand PCL has seen adult diaper sales grow 30 percent this year, and expects double-digit growth over the next five years, said its chief operating officer.

“We see Thailand moving in the direction of Japan whereby the adult diaper market will become larger than the baby diaper market, perhaps in 10 years’ time,” Justine Wang told Reuters.

Another company seeing opportunity in the demographic change is medical equipment supplier Samaphan Health, which with Taiwan’s Apex Medical Corp sells mattresses to prevent bed sores as well as respiratory products to aid sleep.

“Demand from wealthy clients is very strong,” said Managing Director Chinnakarn Samalapa. Sales of its elderly care products have grown 10 percent annually since 2011 and will continue growing, he said. “They don’t mind spending to improve the quality of life for elderly relatives.”

With so much money being spent on care, the government is considering allowing reverse mortgages which would allow elderly homeowners to convert some of their home value into cash – an initiative that would further boost the market for goods and services targeting the elderly, economists said.

But as the market booms, some seemingly essential products and services could take a little longer than others to benefit.

Thai Riei & Elderly Care Recruitment Co opened in January but attracting customers is a challenge, said Facility Manager Pornchanok Jeanmpudsa. The reason, she said, was a cultural perception that nursing homes are places to abandon the elderly.

($1 = 34.7600 baht)

(Reporting by Khettiya Jittapong and Pairat Temphairojana; Additional reporting by Manunphattr Dhanananphorn; Editing by Simon Webb, Miyoung Kim and Christopher Cushing)