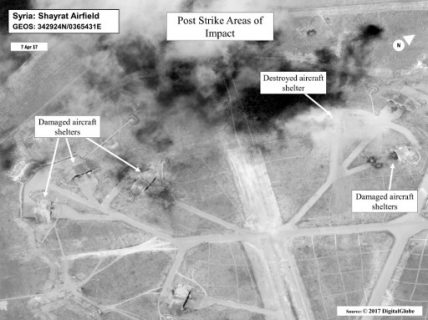

The United States fired Tomahawk missiles into Syria in retaliation for the regime of Bashar Assad using nerve agents to attack his own people. / AFP PHOTO / DoD / Handout –

by John Biers

Agence France Presse

NEW YORK, United States (AFP) — Wall Street stocks finished modestly lower Friday following a disappointing US jobs report, while Pentagon missile strikes on Syria lifted defense shares and oil prices.

Gold prices, a traditional safe haven in times of turbulence, also rallied following the Syria action, while global stock markets were mixed.

The Labor Department reported that the US added just 98,000 jobs in March, far below the expected amount, while unemployment fell to 4.5 percent, its lowest level in nearly 10 years.

But the report was upstaged by President Donald Trump’s move on Syria, which came as Trump met his Chinese counterpart Xi Jinping for the first time in a closely watched summit at the president’s Mar-a-Lago resort in Florida.

Trump’s decision to order military strikes on Syria plunges Washington deeper into the country’s tragedy, although officials said it does not mark a new strategy to oust President Bashar al-Assad by force.

US stock futures fell sharply on the news, but then recovered somewhat as the market viewed the US strikes “as an isolated incident without any meaningful economic impact,” Briefing.com analyst Patrick O’Hare said.

“The message of the market was that the attendant risks related to Syria are still within acceptable tolerance levels,” he said.

But others saw lingering effects, with gold prices hitting a five-month high and oil prices also rising.

“A strong sense of unease infiltrated the financial markets, with investors staying clear of riskier assets,” said FXTM analyst Lukman Otunuga. “The possible threat of geopolitical tensions heightening from the airstrikes has created a risk-off trading atmosphere.”

Oil prices reached one-month highs as the attacks led to concerns about supplies in the Middle East. That helped shares in energy firms rise around the world and pushed London’s commodities-heavy FTSE 100 index into positive territory.

The dollar gained on the euro and other major currencies as traders bet that the US jobs report, while disappointing, would not derail a plan by the Federal Reserve to lift interest rates again this year.

“The key takeaway was that it was keeping the Fed on track with the current pace of tightening,” said Eric Nelson, analyst at Wells Fargo. “Overall, the report was supportive of our story of dollar strength.”

Defense shares were boosted by Trump’s action on Syria, with missile maker Raytheon gaining 1.5 percent. Lockheed Martin climbed 1.2 percent, Northrop Grumman 0.9 percent and Boeing 0.8 percent.

– Key figures at 2045 GMT –

New York – Dow: DOWN less than 0.1 percent at 20,656.10 (close)

New York – S&P 500: DOWN 0.1 percent at 2,355.54 (close)

New York – Nasdaq: DOWN less than 0.1 percent at 5,877.81 (close)

London – FTSE 100: UP 0.6 percent at 7,349.37 (close)

Frankfurt – DAX 30: DOWN 0.1 percent at 12,225.06 (close)

Paris – CAC 40: UP 0.3 percent at 5,135.28 (close)

EURO STOXX 50: UP 0.1 percent at 3,492.52

Tokyo – Nikkei 225: UP 0.4 percent at 18,664.63 (close)

Hong Kong – Hang Seng: FLAT at 24,267.30 (close)

Shanghai – Composite: UP 0.2 percent at 3,286.62 (close)

Euro/dollar: DOWN at $1.0602 from $1.0642

Pound/dollar: DOWN at $1.2375 from $1.2465

Dollar/yen: UP at 111.07 yen from 110.76 yen

Oil – Brent North Sea: UP 35 cents at $55.24 per barrel

Oil – West Texas Intermediate: UP 54 cents at $52.24 per barrel

burs-jmb/bbk

© Agence France-Presse