Holidays give us a break from our routine and help us to refresh ourselves and go back to work with renewed energy. Some people choose to work rather than have a vacation during holidays. The holiday season is usually classified into two types: the “regular holiday” and the “special non-working day”. There is a difference between these two in terms of pay rules. The Department of Labor and Employment (DOLE) stated that an employee shall be given an additional 30% if the holiday falls on his or her rest day, and an additional 30% if he or she works overtime. The seasonal workers may not be paid the required holiday pay during off-season when they are not at work.

According to the websites of DOLE, Labor Advisory No. 06, Series of 2013 on the Payment of Wages for the Regular Holidays, Special (Non-working) Days, and Special Holiday (For all Schools) for the Year 2014, specifically promulgating the rules that shall apply, are as follows:

• If the employee did not work, he/she shall be paid 100 percent of his/her salary for that day. Computation: (Daily rate + Cost of Living Allowance) x 100%. The COLA is included in the computation of holiday pay.

• If the employee worked, he/she shall be paid 200 percent of his/her regular salary for that day for the first eight hours. Computation: (Daily rate + COLA) x 200%. The COLA is also included in computation of holiday pay.

• If the employee worked in excess of eight hours (overtime work), he/she shall be paid an additional 30 percent of his/her hourly rate on said day. Computation: Hourly rate of the basic daily wage x 200% x 130% x number of hours worked.

• If the employee worked during a regular holiday that also falls on his/her rest day, he/she shall be paid an additional 30 percent of his/her daily rate of 200 percent. Computation: (Daily rate + COLA) x 200%] + (30% [Daily rate x 200%)].

• If the employee worked in excess of eight hours (overtime work) during a regular holiday that also falls on his/her rest day, he/she shall be paid an additional 30 percent of his/her hourly rate on said day. Computation: (Hourly rate of the basic daily wage x 200% x 130% x 130% x number of hours worked);

Special (Non-working) Days

• If the employee did not work, the “no work, no pay” principle shall apply, unless there is a favorable company policy, practice, or collective bargaining agreement (CBA) granting payment on a special day.

• If the employee worked, he/she shall be paid an additional 30 percent of his/her daily rate on the first eight hours of work. Computation: [(Daily rate x 130%) + COLA).

• If the employee worked in excess of eight hours (overtime work), he/she shall be paid an additional 30 percent of his/her hourly rate on said day. Computation: (Hourly rate of the basic daily wage x 130% x 130% x number of hours worked).

• If the employee worked during a special day that also falls on his/her rest day, he/she shall be paid an additional fifty percent of his/her daily rate on the first eight hours of work. Computation: [(Daily rate x 150%) + COLA].

• If the employee worked in excess of eight hours (overtime work) during a special day that also falls on his/her rest day, he/she shall be paid an additional 30 percent of his/her hourly rate on said day. Computation: (Hourly rate of the basic daily wage x 150% x 130% x number of hours worked).

Special Holiday for all schools

For private establishments, 25 February 2014 is an ordinary workday and no premium is required to be paid for work on said day.

On the other hand, employees in private schools, whether academic or administrative personnel, shall be paid in accordance with the rules for pay on special (nonworking) days as stated in Labor Advisory No. 06, Series of 2013.

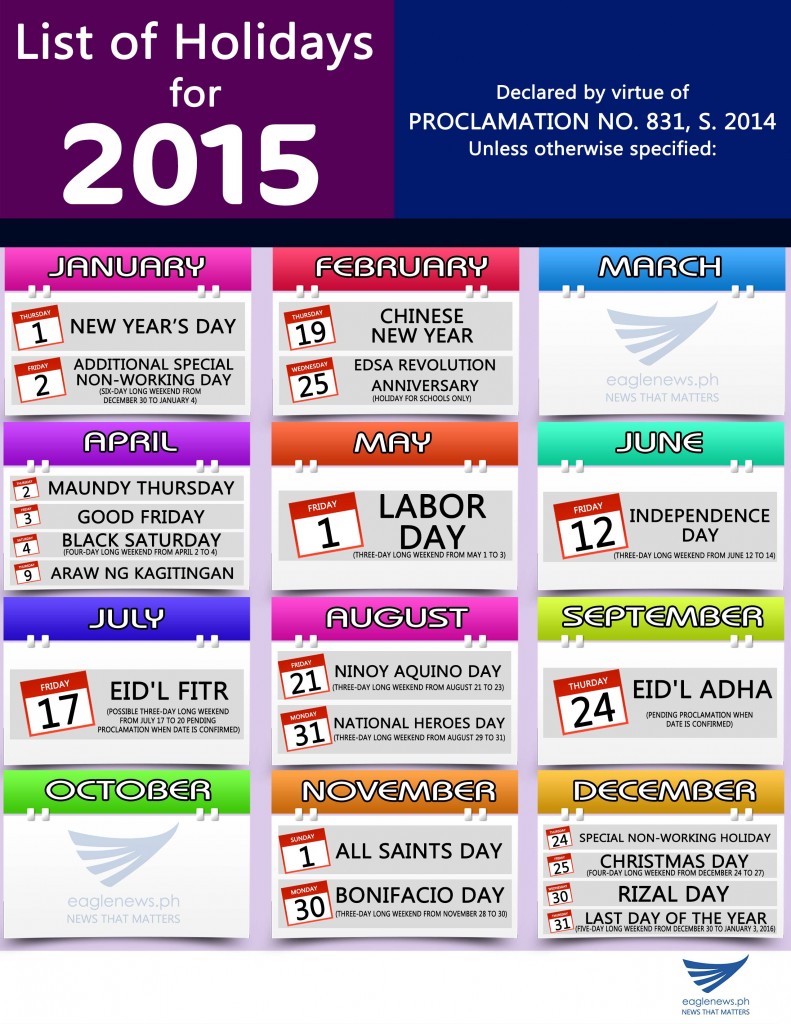

Here is the PROCLAMATION NO. 831 declaring the regular holidays, special (non-working) days and special holiday (for all schools) for the year 2015

Regular Holidays.

New Year’s Day – 1 January (Thursday)

Maundy Thursday – 2 April Good Friday – 3 April

Araw ng Kagitingan – 9 April (Thursday)

Labor Day – 1 May (Friday)

Independence Day – 12 June (Friday)

National Heroes Day – 31

August (Last Monday of August)

Bonifacio Day – 30 November (Monday)

Christmas Day – 25 December (Friday)

Rizal Day – 30 December (Wednesday)

Special (Non-Working)

Days Chinese New Year – 19 February (Thursday)

Black Saturday – 4 April Ninoy Aquino Day – 21 August (Friday)

All Saints Day – 1 November (Sunday)

Additional special (non-working) days – 2 January (Friday) – 24 December (Thursday)

Last Day of the Year – 31 December (Thursday)

Special Holiday (for all schools)

EDSA Revolution Anniversary – 25 February (Wednesday)

Holidays are exciting times and full of new experiences and adventures. We must remember that Holiday traditions are an essential part to building a strong bond between family, and our community. Through this season, it keeps the memories of the past alive and helps us share them with newer generations. A traditional celebration of holidays has been around as long as recorded history.

Reference: http://www.dole.gov.ph/

by: Sharmaine Lorido